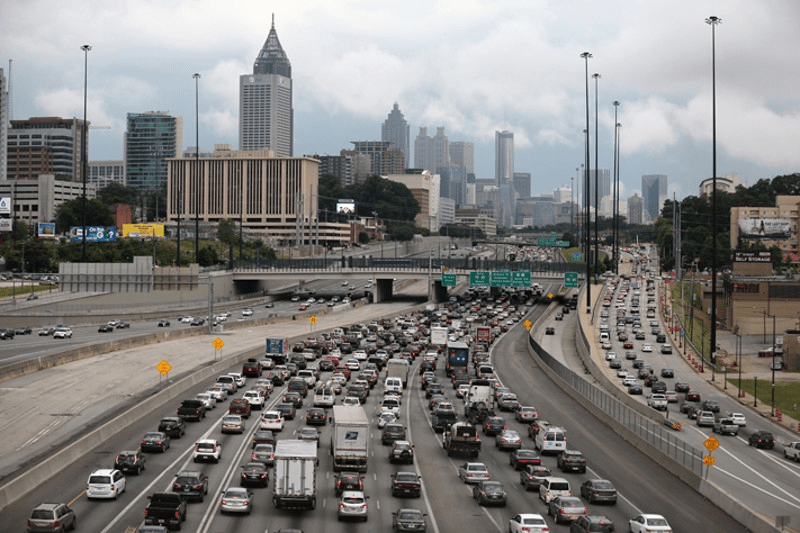

Atlanta’s industrial market is entering a new chapter — not of collapse, but of correction.

After years of unstoppable growth, the numbers tell a different story in 2025.

Supply Is Rising — But Demand Is Cooling

Over the past year, Metro Atlanta has seen:

📦 1.28M SF delivered in Q1 2025 — one of the largest quarterly outputs in recent memory.

🚧 8.7M SF still under construction — adding ~1.5% to total inventory when complete.

📉 10.5% vacancy (Q3 2025) — the highest in nearly a decade.

💼 Leasing down ~42.5% YoY, with –2.3M SF net absorption last quarter.

Despite this, average rents remain stubbornly high at $9.86/SF, up 6% quarter-over-quarter.

Translation: the market is slowing — but not surrendering.

Deals That Define the Moment

1️⃣ Lake City Distribution Center (South I-85 / Airport Corridor)

✅ Sold for $30M

✅ 157,000 SF | 32’ clear | 42 dock doors

✅ Fully leased to Maersk & DB Schenker

➡️ Even in a cooling market, credit-backed infill assets still command premium pricing.

2️⃣ Great Valley Commerce Center (I-75 North Corridor)

✅ 290,000 SF Class A facility leased to Vanderlande (Toyota Industries)

✅ Proof that infrastructure-aligned locations still attract institutional capital.

3️⃣ Dogwood Logistics Center (Conyers)

✅ $44M in joint-equity & construction financing secured

✅ Two Class A buildings totaling 389,000 SF

✅ Confidence remains for disciplined, well-located new builds.

🔍 The Takeaway: Power Is Shifting

Here’s what’s reshaping Atlanta’s industrial landscape:

📍 Location premium is widening – Infill wins; peripheral supply lags.

🏢 Credit tenancy is king – Investment-grade tenants drive stability.

🚨 Spec development is high risk – Focus on absorption-ready corridors.

🤝 Tenants are regaining leverage – Expect more concessions and shorter terms.

⚡ Final Thought

Atlanta’s industrial market is evolving, not eroding.

For investors — it’s time to focus on location, liquidity, and lease quality.

For tenants — now is the time to negotiate from strength before the next rebound.

If you’re evaluating an asset, considering a lease, or repositioning your portfolio,

I can help you interpret which submarkets are cooling — and where the real opportunities lie.

AtlantaIndustrial #CommercialRealEstate #IndustrialRealEstate #CREInsights #AtlantaCRE #LogisticsRealEstate #IndustrialInvestment #WarehouseDevelopment #MarketUpdate #RecardoLaidford #TenantRepresentation #IndustrialBroker #AtlantaBusiness

Leave a comment